Electric car revolution may drive oil ‘investor death spiral’

The multi-trillion-dollar ‘big crash’ could start as soon as 2023, Bloomberg warns.

Advanced batteries could “tip the oil market from growth to contraction earlier than anticipated,” concludes the credit rating agency Fitch in a new study. Bloomberg New Energy Finance (BNEF) has already told investors to expect the ‘big crash’ in oil by 2028 — and as early as 2023.

Fitch Ratings agency warns that if recent technology trends continue, we may see an “investor death spiral” as first the smart money — and then everyone else’s — sell off oil company assets (bonds and stocks). That would in turn increase the industry’s costs for both debt and equity — while oil prices would be stuck at low levels as the world hits peak demand.

This would affect industries whose stocks and bonds are cumulatively valued in the trillions of dollars. In particular, Fitch notes, “an acceleration of the electrification of transport infrastructure would be resoundingly negative for the oil sector’s credit profile.”

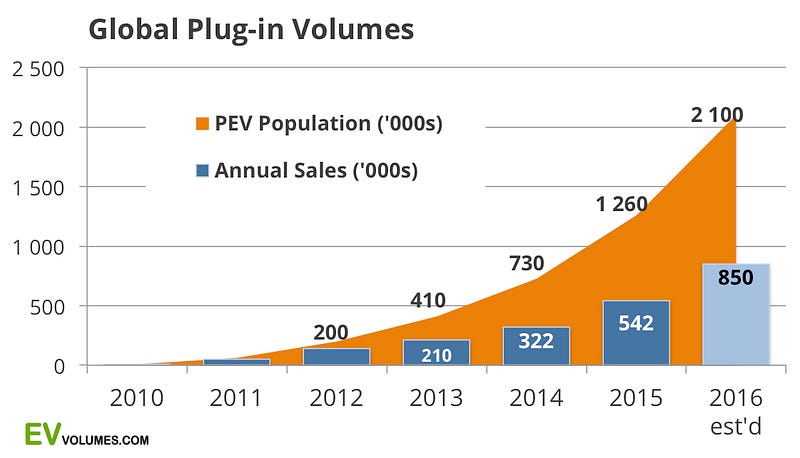

It’s clear the electric vehicle (EV) revolution is accelerating worldwide (see my Wednesday post and the figure above). EV sales have been growing faster than 50 percent a year. Countries from Norway to Germany to India are racing to ban fuel-burning cars and go all electric.

“Global oil demand growth is slowing at a faster pace than initially predicted,” the International Energy Agency (IEA) found in its September oil market report. “We see a slowing down of oil demand growth in China,” explained IEA chief Fatih Birol, and a “major reason” is that cars are rapidly getting more fuel-efficient.

Birol notes the efficiency trend will continue since many growing countries “such as India, such as (countries in) South East Asia, have not yet set the fuel economy standards.” EV adoption speeds up the overall trend.

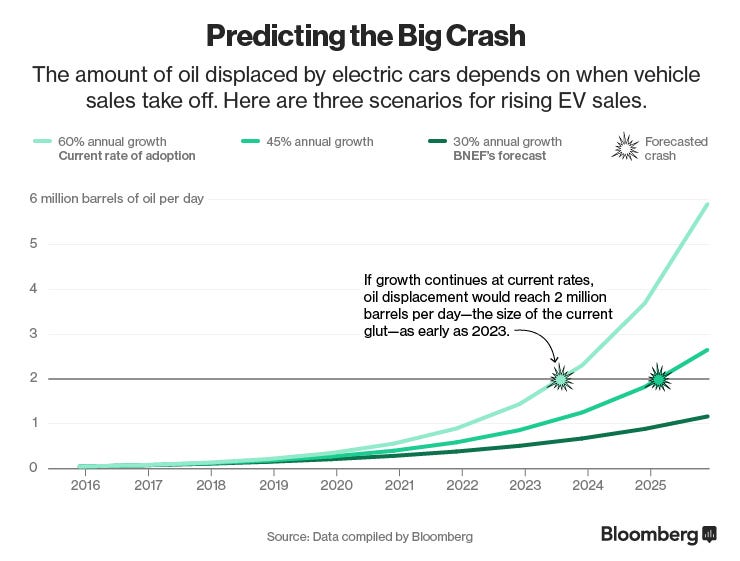

BNEF has pointed out that a global glut of 2 million barrels a day is what triggered the 2014 oil price collapse. Their analysis concluded that if electric vehicles continued their recent growth rate, EVs could displace that much oil demand “as early as 2023.”

BNEF, however, believes “compound annual growth rates as high as 60 percent can’t hold up for long.” Their own “more methodical” forecast breaks down EVs “to their component costs to forecast when prices will drop enough to lure the average car buyer.” In BNEF’s model, we see only 30 percent annual growth rate in EVs and cross the oil-crash benchmark five years later in 2028.

Of course, the smart money generally acts sooner, rather than later. Climate hawk Bill McKibben and others have been warning people to divest from fossil fuel investment for years now. Those who listened avoided the big crash in coal company stock prices and the impact of the 2014 oil price crash.

It’s not too late to avoid the next oil shock. While predictions of the exact year it comes are necessarily imperfect, Bloomberg offers this sage advice:

“One thing is certain: Whenever the oil crash comes, it will be only the beginning. Every year that follows will bring more electric cars to the road, and less demand for oil. Someone will be left holding the barrel.”